|

|

|||||||

| Coffee Shop Talk of a non sexual Nature Visit Sam's Alfresco Heaven. Singapore's best Alfresco Coffee Experience! If you're up to your ears with all this Sex Talk and would like to take a break from it all to discuss other interesting aspects of life in Singapore, pop over and join in the fun. |

|

|

|

Thread Tools |

|

#1

|

|||

|

|||

|

An honorable member of the Coffee Shop Has Just Posted the Following:

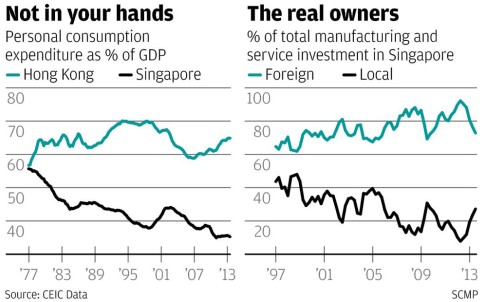

UPDATED : Tuesday, 04 February, 2014, 3:00pm SOUTH CHINA MORNING POST 南華早報 Singaporeans not as wealthy as GDP figures suggest HK performs better than the Lion City on the basis of personal consumption expenditure OK, let's play games with GDP numbers as these are what Singapore bureaucrats love to play and as the numbers are not quite what they seem. We shall start by conceding the headline figures. Yes, as of the latest statistical releases, GDP at prevailing rates of exchange runs at an annual rate of about US$52,000 per person of the total population in Singapore and US$37,000 in Hong Kong, which puts Singapore about 40 per cent ahead, not just 25 per cent. The point about GDP, however, is that it is meant to be a measure of wealth. It does not mean much to you unless it represents wealth that finds its way into your hands, that is, unless it takes the form of a component of GDP called personal consumption expenditure. In Singapore, personal consumption expenditure has steadily fallen over the years as a percentage of GDP and, at 35 per cent, is now barely half of what it is in Hong Kong. This is an oddity characteristic of a startup economy, not of a wealthy town like Singapore. But it means that, on the basis of our money-in-your-hands measure, Hong Kong at US$24,000 per capita still outranks Singapore at US$21,000. The second chart gives you a clue as to why the two economies are so different on this measure. Industrial investment in Singapore, always predominantly foreign, has become even more so in recent years, accounting for an average of about 80 per cent of total investment over the past 10 years. I do not have the equivalent figures for Hong Kong but, at a rough guess, the foreign-local ratio would be the reverse. This foreign investment in Singapore has in turn produced a huge trade surplus in both goods and services. Over recent years, it has run at about 30 per cent of GDP. And most of this money goes right back out again to pay foreigners for all the confidence they have shown in Singapore by investing in it so heavily. In short, Singapore's high GDP numbers are mostly an anomaly created by very generous industrial concessions to foreigners. They do not really reflect domestic wealth.  This article appeared in the South China Morning Post print edition as Singaporeans not as wealthy as GDP figures suggest Click here to view the whole thread at www.sammyboy.com. |

| Advert Space Available |

|

| Bookmarks |

| Thread Tools | |

|

|